Empowering Modern Utilities: The Essential Investment in High-Performance Accounting Software

In an era where technological advancements are reshaping industries and redefining the very essence of efficiency, utilities find themselves at a crucial crossroads. Ever-growing demand for reliable energy services has placed an enormous burden on rate-regulated utilities to streamline their operations and optimize every facet of their business. However, many utilities continue to rely on outdated accounting systems and processes that limit their ability to adapt to an evolving landscape. Investment in high-performance computing is becoming critical for operational success, and utilities need a viable plan for transitioning to the best available accounting technology in order to drive sustainable growth in a competitive market.

The Current Landscape

Historically, rate-regulated utilities have been reactive in terms of adopting technology. The industry has learned to tolerate chronic data issues and outdated software solutions designed for a different era. These legacy systems struggle to keep up with even basic changes to the regulatory environment, which is a critical aspect of tax accounting for utilities. As tax laws evolve and become more complex, the pressure on utilities to stay compliant while optimizing their tax strategies has never been greater.

Support networks for these outdated platforms are dwindling as the industry shifts its focus to more modern technologies. This leaves late-transitioning utilities stranded with systems that lack the support needed to address issues, provide updates, or offer assistance in navigating the complex world of tax accounting. These limitations have serious implications for utilities striving to maximize efficiency and maintain financial accuracy.

The Power of Modern Accounting Technology

Tax accounting regulations regularly evolve to become more complex, and the assets of rate-regulated utilities continually grow both in number and dollar value. With calculations becoming more complicated and inputs becoming larger and more numerous, tax accounting software requires progressive solutions to meet the growing needs of the industry.

Transitioning to modern accounting software represents a pivotal step towards a brighter future for utilities. By automating manual tasks, such as data entry and reconciliation, utilities can significantly reduce the risk of human error, ensuring that financial records are not only accurate but also compliant with intricate tax regulations. Modern accounting software is not just a tool; it is a strategic asset that enriches reporting capabilities, providing comprehensive insights that drive informed decision-making. As utilities navigate an increasingly complex environment, investing in the latest technology is not a choice, but a necessity.

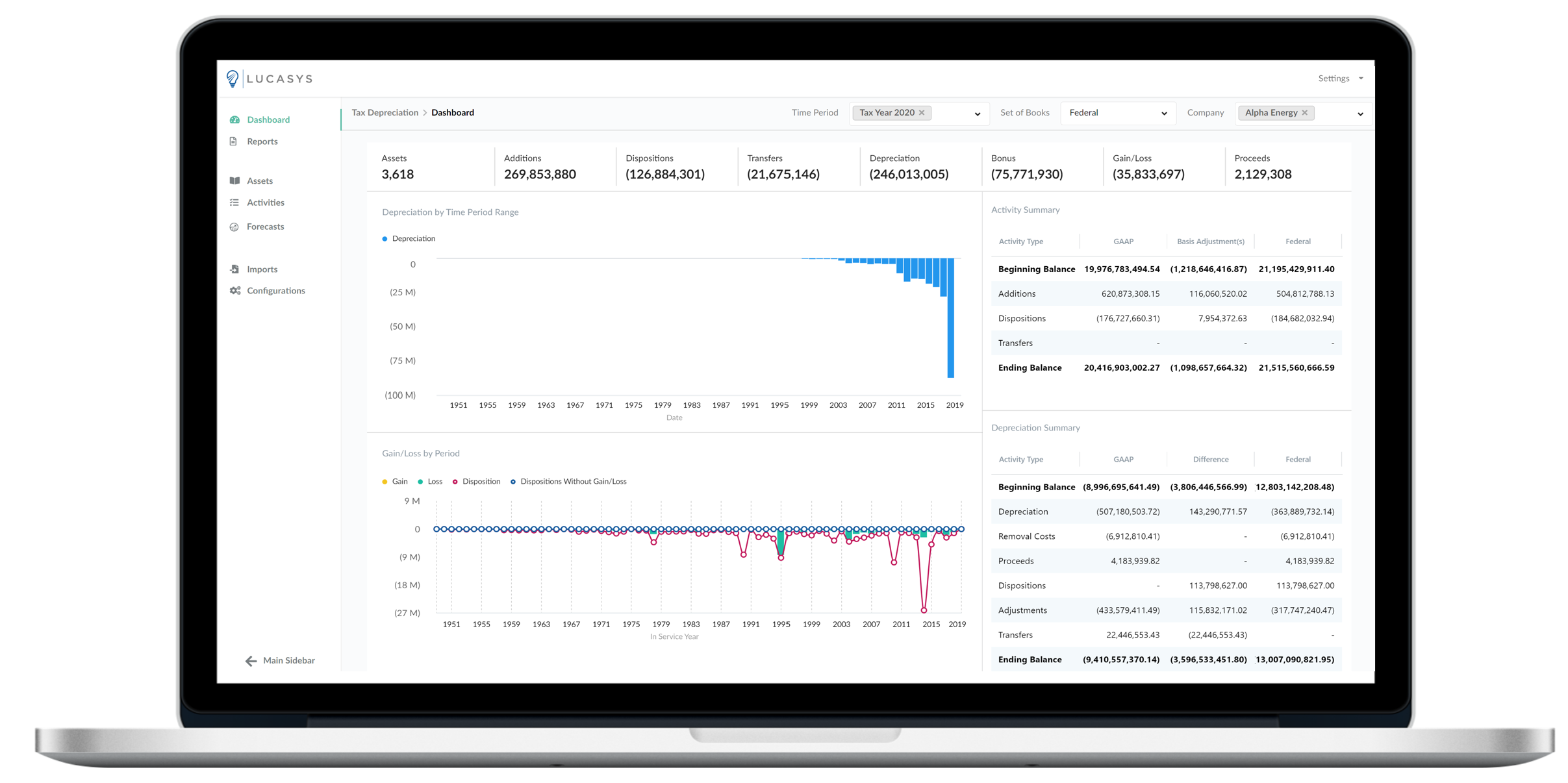

Tax Depreciation Reinvented

Lucasys Depreciation represents a prime example of technological innovation in today's rapidly evolving utility landscape. Depreciation calculations are seamlessly streamlined and automated with modern computing toolsets, which reduces the risk of human errors and ensures the accuracy of financial reports. With modernized data integration, users can effortlessly synthesize information from various systems, enhancing data accuracy and expediting processes. Moreover, its user-friendly interface makes it accessible and intuitive for end-users, transforming what can be a daunting task into an efficient process. In an era where time and precision are crucial, Lucasys Depreciation ushers in a new era of efficiency and accuracy in financial management practices.

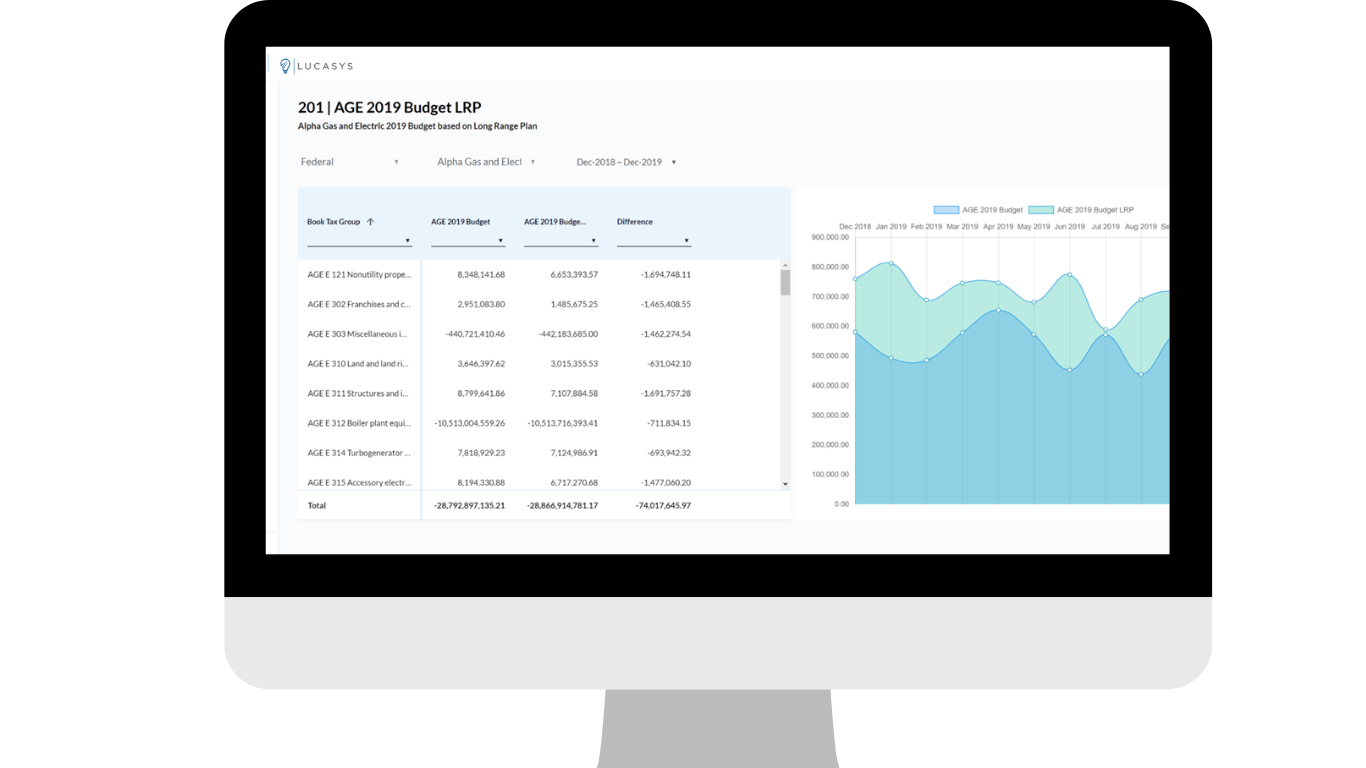

Navigating Deferred Income Taxes

In the past, utilities currently have had incredibly limited options for deferred tax calculations such as ARAM and excess deferred tax reversals. Enter Lucasys Deferred Tax, a game-changer in the world of financial management for utilities. Featuring simplified configurability, utilities can easily tailor the system to the unique needs of their business. By seamlessly weaving together information from various sources to provide a holistic view of financial data, book and tax data is interfaced cleanly and simply. Unlike outdated platforms which often leave users grappling with complex calculations and reconciliations, Lucasys Deferred Tax makes deferred tax calculations not only efficient but also transparent and comprehensible. With this cutting-edge software in their arsenal, utilities can navigate the intricacies of deferred tax tracking with unprecedented ease, ensuring both accuracy and agility in their financial operations.

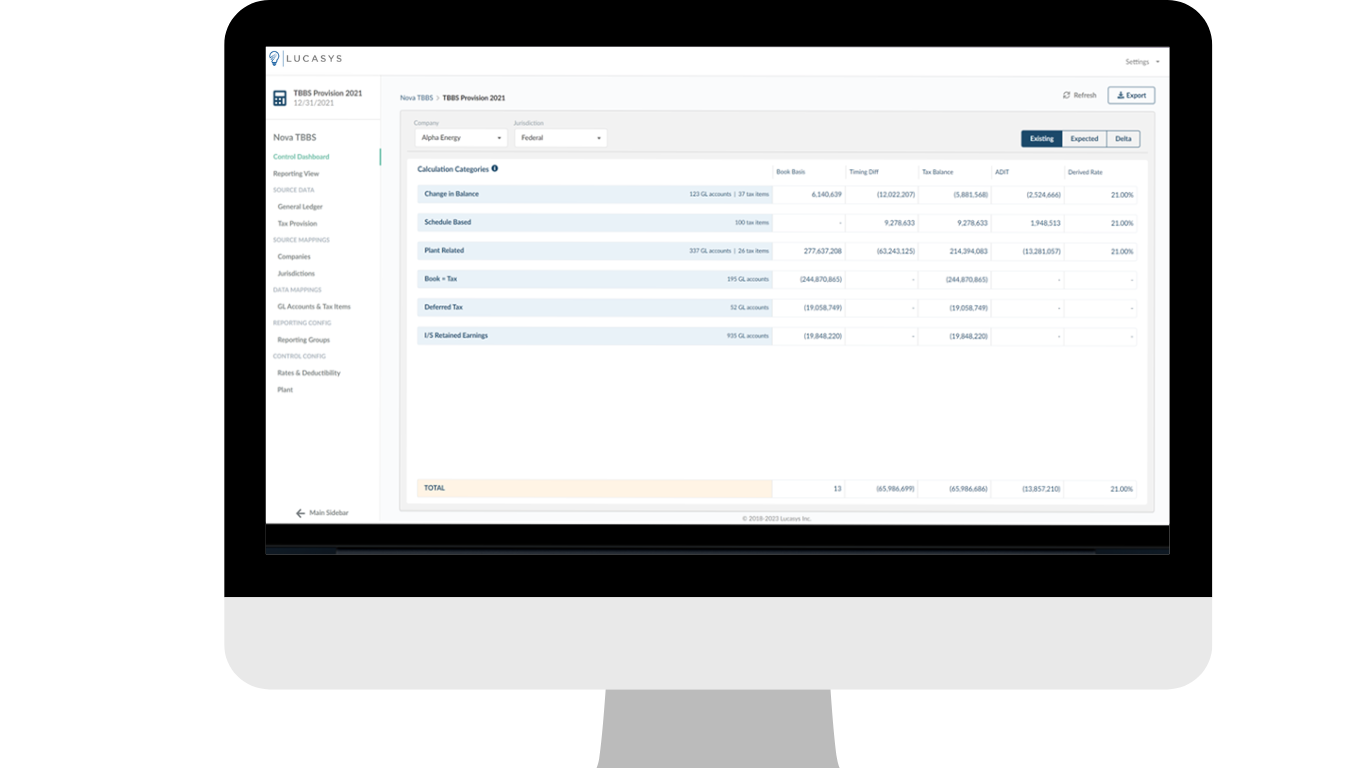

Transforming Tax Basis Balance Sheets

Tax basis balance sheets have long been a pain-point for even the most organized utilities. The lack of toolsets in the industry has led many businesses to rely on cumbersome spreadsheets and workbooks, which are error-prone and difficult to maintain. Lucasys Nova has emerged as the gold-standard for ensuring regulatory compliance in tax basis balance sheets. Accounts can be mapped with ease, providing utility companies with an intuitive tool that streamlines the complex process of reconciliation. Interfaces are designed with end-users in mind, making navigation and data entry a breeze even for those without extensive accounting backgrounds. Moreover, this software boasts automated built-in validations, offering a level of error-checking that not only enhances data accuracy but also saves time and resources. As utilities seek to optimize their financial operations, Lucasys Nova emerges as the best-in-class solution for tax basis balance sheet automation, elevating operational efficiencies to new heights.

How Lucasys Can Help

As utilities reevaluate their business processes and explore the next generation of software solutions, Lucasys stands as an industry leader. Whether looking for new software or trying to get the most value out of existing solutions, Lucasys can provide insights into the latest accounting and tax issues facing the utility industry. To learn more about how Lucasys can help visit https://www.lucasys.com/solutions.