Navigating the PowerTax End of Life: What Utilities Need to Know and How to Transition Smoothly to Lucasys Tax

As a utility company, you rely on robust, reliable software to manage complex tax processes efficiently. For decades, PowerPlan’s PowerTax software has been the only available industry-focused tax fixed asset solution. However, the Lucasys team has heard from many utilities that PowerPlan has communicated an End of Life for its PowerTax software. If your organization has been told that PowerTax is reaching its End of Life, you may now be facing the urgent task of finding a new solution to replace your legacy solution. The discontinuation of any software poses significant challenges, but it also presents an opportunity to upgrade to more advanced, future-proof technology like Lucasys Tax.

The Implications of Software End of Life

An End of Life announcement by a software vendor marks the cessation of all updates, support, and security patches for the software. This scenario brings several critical implications for utility companies that continue to rely on unsupported software:

1. Increased Security Risks: Without ongoing security patches, discontinued software may become increasingly vulnerable to cyber threats. This puts sensitive financial and tax data at risk, which could lead to significant financial and reputational damage.

2. Lack of Support: As the solution phases out, there may be no technical support available. This means that any issues or bugs that arise may be left unresolved, potentially disrupting your tax processes at critical times.

3. Compliance Challenges: With tax regulations continually evolving, staying compliant requires regular software updates to accommodate new rules and guidelines. Without these updates, your utility’s tax department may struggle to meet compliance requirements, leading to penalties or fines.

4. Operational Inefficiencies: As the software becomes outdated, it may no longer integrate well with other systems or handle the complexities of modern tax environments, leading to increased manual work, errors, and inefficiencies.

Given these significant risks, continuing to use legacy software beyond its End of Life may not be a viable option for utilities that need to stay secure, compliant, and efficient. The time to act is now, and Lucasys Tax offers the perfect alternative.

Introducing Lucasys Tax: Your Next-Generation Tax Solution

Lucasys Tax is modern, comprehensive tax software designed specifically for the utility industry. With Lucasys Tax, your company can seamlessly transition from PowerTax to a more advanced platform that offers robust features, enhanced security, and ongoing support to meet your current and future tax needs.

Here’s how Lucasys Tax stands out as the ideal replacement:

1. Fast Conversions: Your organization can adopt Lucasys Tax in as little as a few weeks, converting your existing data, and incorporating any off-line data as well.

2. Seamless Integration: Lucasys Tax integrates effortlessly with your existing fixed asset and income tax software, minimizing disruption during the transition and enabling smoother operations across your tax and financial departments.

3. Advanced Security Features: Lucasys Tax is built with the latest security protocols to protect your data against cyber threats, ensuring your sensitive information remains safe.

4. Continuous Support and Updates: Lucasys Tax is fully supported with regular updates that keep the software aligned with the latest tax legislation, regulatory requirements, and technological advancements.

5. Automated Compliance: Lucasys Tax automates compliance and reporting tasks, reducing the risk of human error and ensuring that your utility stays ahead of regulatory changes.

6. Scalable and Future-Proof: As your operations grow, Lucasys Tax scales with you, providing the flexibility and power needed to handle increasing complexity and volume.

Taking the Next Steps: How to Ensure a Smooth Transition to Lucasys Tax

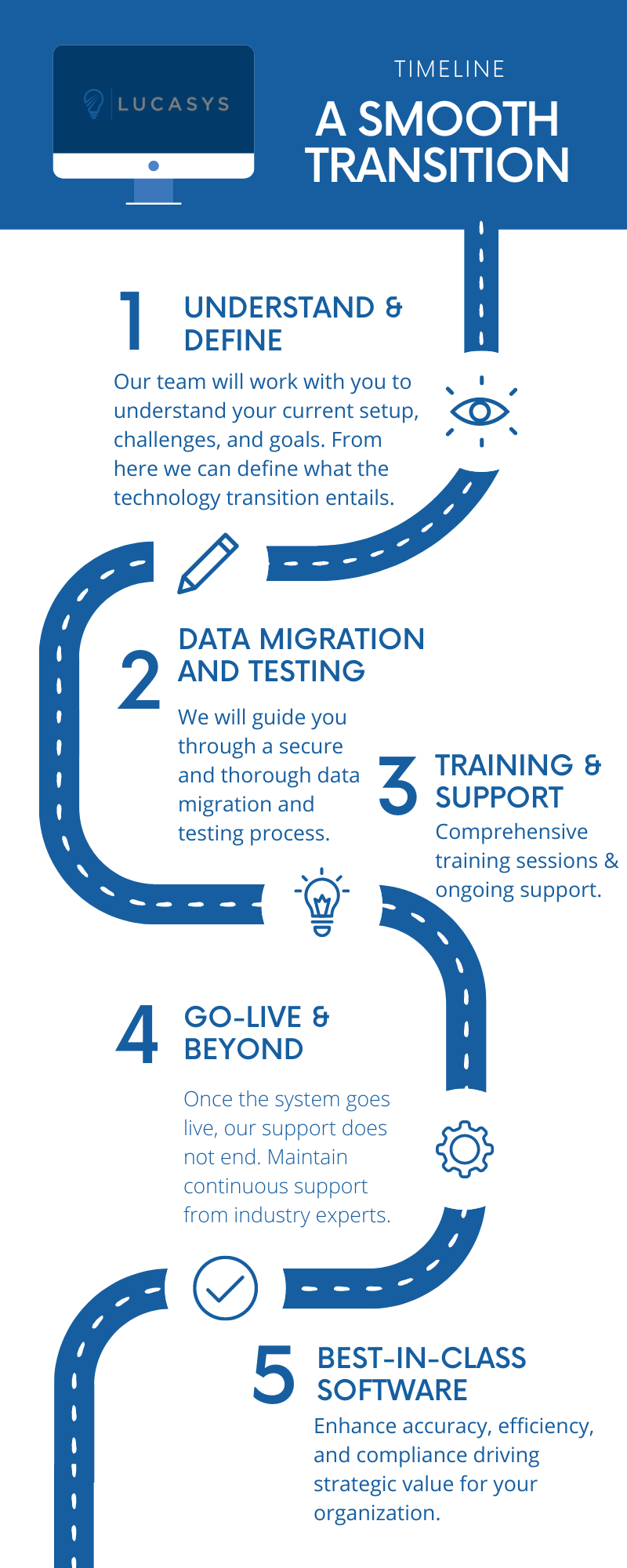

Transitioning away from PowerTax doesn’t have to be a daunting process. Lucasys offers a structured, step-by-step migration plan designed to ensure minimal disruption and maximum efficiency:

1. Initial Consultation: Our team will work with you to understand your current setup, challenges, and goals. This helps us tailor the transition process to meet your specific needs.

2. Data Migration and Testing: We’ll guide you through a secure data migration process, followed by rigorous testing to ensure that all data has been accurately transferred and that the new system is functioning flawlessly.

3. Training and Support: To help your team get up to speed quickly, we provide comprehensive training sessions and ongoing support to ensure they are comfortable using the new software.

4. Go-Live and Beyond: Once the system is live, our support doesn’t end. We offer continuous assistance to address any questions or issues that may arise, ensuring your tax operations run smoothly.

The End of Life for PowerTax marks a critical juncture for utilities. While the discontinuation of legacy software poses challenges, it also provides an opportunity to adopt a more secure, efficient, and future-ready solution with Lucasys Tax. By making the transition now, you can ensure your utility’s tax department is well-equipped to handle the demands of today and tomorrow.

Ready To Make the Switch?

Contact Lucasys today to learn more about how Lucasys Tax can support your utility’s tax needs and to schedule your initial consultation. Let’s work together to ensure a smooth transition and set your company up for continued success in a rapidly changing environment. https://www.lucasys.com/contact