Strategy and the Role of Tax

I’m reading a book, Strategy That Works by Paul Leinwand and Cesare R. Mainardi, because, of course, that’s what you do when you are semi-retired. As I read, I reflected on how strategy at most utility companies is directed at becoming more efficient and more effective operationally while finding a way to otherwise reduce costs to offset continuing customer rate pressure. The tax department’s role today generally has 2 components both related to cost savings: (1) deliver tax savings that lower tax expense for the company or tax costs recoverable in rates, and (2) deliver costs savings from operating more efficiently. In my prior VP of Tax life, the role was reflected in my annual presentation to the Board of Directors which I always led with a representation that the Tax Department has 3 goals: (1) to minimize tax expense, (2) to minimize current cash taxes and (3) to manage risk, and then show our steps to deliver on each.

Today, I’m going to focus on being prudent in the decisions impacting whether Tax can deliver operational cost savings and manage the risk that operational costs do not grow. While the foregoing discussion will be related to the timing and process for at least evaluating alternative fixed asset/deferred tax systems, it equally applies to other decisions, including outsourcing and the use of third-party consultants.

Why: For the industry, labor costs are rising, interest costs have risen, significant investments are required to modernize utility systems without increasing kWh or mcf distributed, customer dissatisfaction is growing, and public service commissions are under pressure. All these pressures yield an environment that places an obligation on every leader to make well-informed decisions on items impacting company costs currently and in the future.

When: For fixed asset/deferred tax systems, the industry has come to or is approaching a crossroads. Existing client-resident PowerTax systems are reaching the end of life (i.e., when PowerTax will discontinue support on the particular version). To continue to use, a utility companies are told they must go to the Tax Fixed Asset cloud version. There are consequences to that conversion, discussed below, but the required adoption of a new solution presents an ideal time to take a look around and see what else is out there.

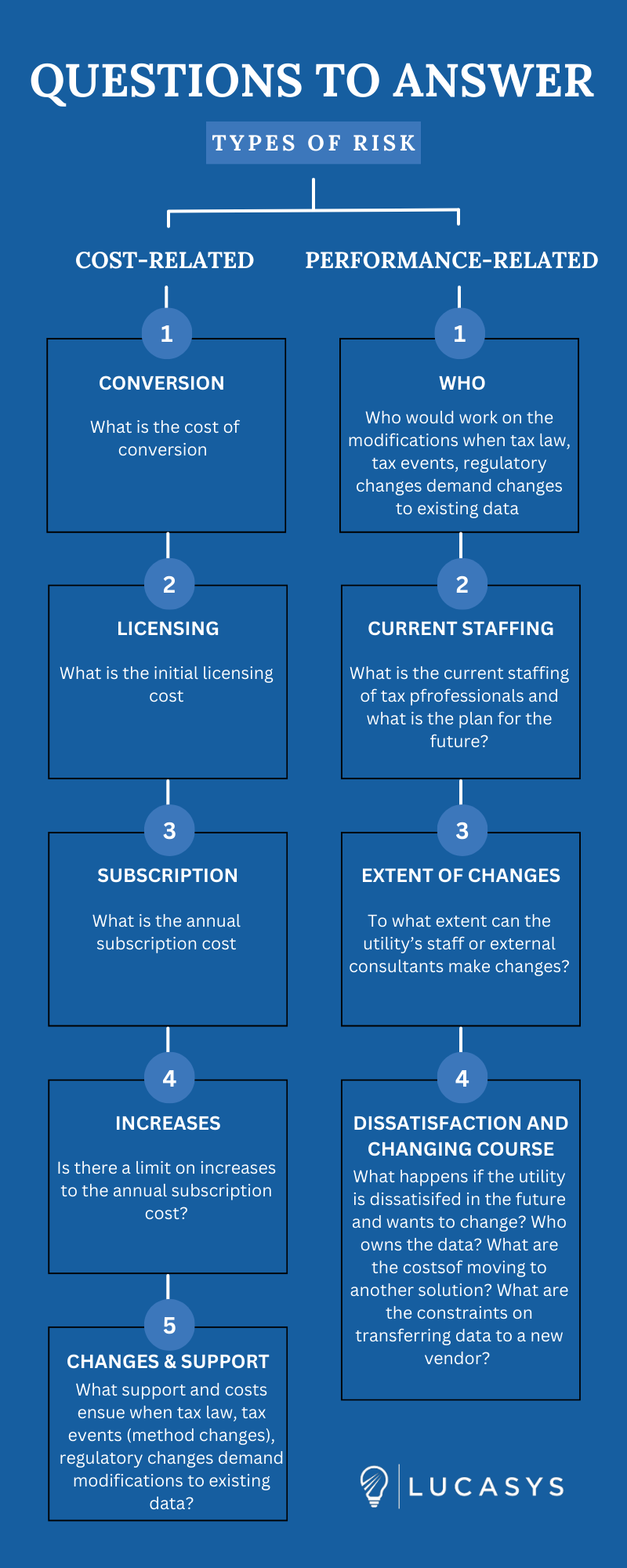

What: Having been in industry, I know a lot of questions I would want to have answered by any fixed asset/deferred tax system sponsor that relate to managing risks.

Cost-related risks: Having seen firsthand and heard from the industry about costs that seem to be skyrocketing out of control, I would need answers to these questions:

What is the cost of conversion?

What is the initial licensing cost?

Is there an annual subscription cost?

Is there a limit on increases to the annual subscription costs?

What support and costs would ensue when tax law, tax events (method changes), regulatory changes demand modifications to existing data?

Performance-related risks: From years of experience of having people tell me that we need a certain person helping us or lack of help from help(less) desks, I would need performance related answers and commitments.

Who would work on the modifications when tax law, tax events (method changes), regulatory changes demand changes to existing data?

What is the current staffing of tax professionals and what is the plan for the future?

To what extent can the utility’s staff or external consultants make changes?

What happens if the utility decides it is dissatisfied in the future and wants to change? Who owns the data? What are the costs of moving to another solution? What are the constraints on transferring data to a new vendor?

The Why, When and What questions flesh out to what extent a decision today is “until death do us part”, because, like from what I hear from friends, the cost of divorce can be onerous.

Inquiring Heads of Tax want to know, and I want to know.