TBBS: an Increasingly Important Internal Control

Tax basis balance sheets (“TBBS”) are a foundational part of any tax department’s controls. While invaluable for supporting tax positions for financial reporting, without proper maintenance these critical workpapers can quickly develop inaccuracies. More and more utilities are finding that their tax basis balance sheet controls are insufficient, and without proper automation, this can lead to an immense and recurring manual effort for tax departments looking to preserve reliable tax accounting records.

What Is a Tax Basis Balance Sheet?

Similar to the way that financial statement balance sheets represent the book basis of assets and liabilities in accordance with GAAP, tax basis balance sheets represent the tax basis of assets and liabilities in accordance with tax rules and regulations by tax jurisdiction. This provides support for the cumulative timing differences between book basis and tax basis that, in turn, support the deferred taxes on the general ledger.

TBBS have not always been leveraged by tax departments. In the past, very little attention was paid to tax-sensitive accounts on the balance sheet, as the income statement was used to calculate the tax provision. Financial statement auditors were primarily concerned with the tax expense on the income statement and the effective tax rate. As such, tax departments spent the majority of their time deriving the total tax expense and spent less time on the support of deferred tax items.

This mentality changed when the Financial Accounting Standards Board (FASB) issued new accounting guidance in the early 1990s. It was determined that the income statement approach was insufficient for financial reporting, and standards were issued that required companies to begin using the balance sheet method when performing accounting for income taxes.

In contrast to the income statement method, the balance sheet method requires that temporary book/tax differences recorded on the balance sheet represent the future value of the temporary book/tax amounts. Tracking these temporary differences on balance sheets necessitates substantially more documentation, and led to a sea-change in financial accounting methods.

Benefits of a Tax Basis Balance Sheet

Though the process requires more effort, investing resources in maintaining a proper tax basis balance sheet is the best way for any company to validate that its deferred tax accounts are complete and accurate.

The record of tax basis assets and liabilities and reconciliation of deferred income tax account balances provides significant support and auditability, which is critical to a successful year-end audit. Financial statement auditors can more efficiently perform audit procedures, which in turn reduce the resources required of tax departments to resolve audit inquiries.

Beyond the benefit to auditors, multiple groups within tax departments rely on tax basis balance sheets for their own purposes. For example, tax compliance personnel record updates to tax accounts after tax returns are filed, and tax accountants utilize the TBBS to calculate the provision accruals and return-to-provision adjustments.

Transparency of book/tax differences is another primary benefit, as a tax basis balance sheet requires the tax department to scrutinize all existing temporary book and tax differences and to determine if basis differences exist for which a book/tax difference has not been recorded. The ability to perform such analyses are not only useful for identifying the implications of potential tax accounting method changes, but the record also serves as critical supporting documentation for a company’s tax basis and demonstrates reliability in tax accounts to potential investors or buyers.

Though there are a litany of benefits to implementing a tax basis balance sheet, maintaining the TBBS takes perpetual attention and review. The benefits of the TBBS are only realized when upkeep is made a priority, as allowing maintenance to become lax very quickly leads to issues.

Maintaining a Tax Basis Balance Sheet

In contrast to the income statement method, the balance sheet method requires that deferred taxes be recorded in order to reflect the future value of the temporary book/tax amounts. Tracking these temporary differences on the balance sheet necessitates substantially more documentation, and many tax departments elect to track only those deferred tax adjustments that they deem material, such as depreciation/amortization and tax credits. This may be simpler, but often does not provide the complete picture that auditors expect from tax basis balance sheets.

Because not all deferred items are analyzed at year-end, it is difficult to reconcile the true end-of-year value of deferred tax balances. As such, it is often simpler to only track the deferred tax movement. The risk of this approach is that the total tax account balances may be misstated, as the beginning account balance may not be maintained correctly.

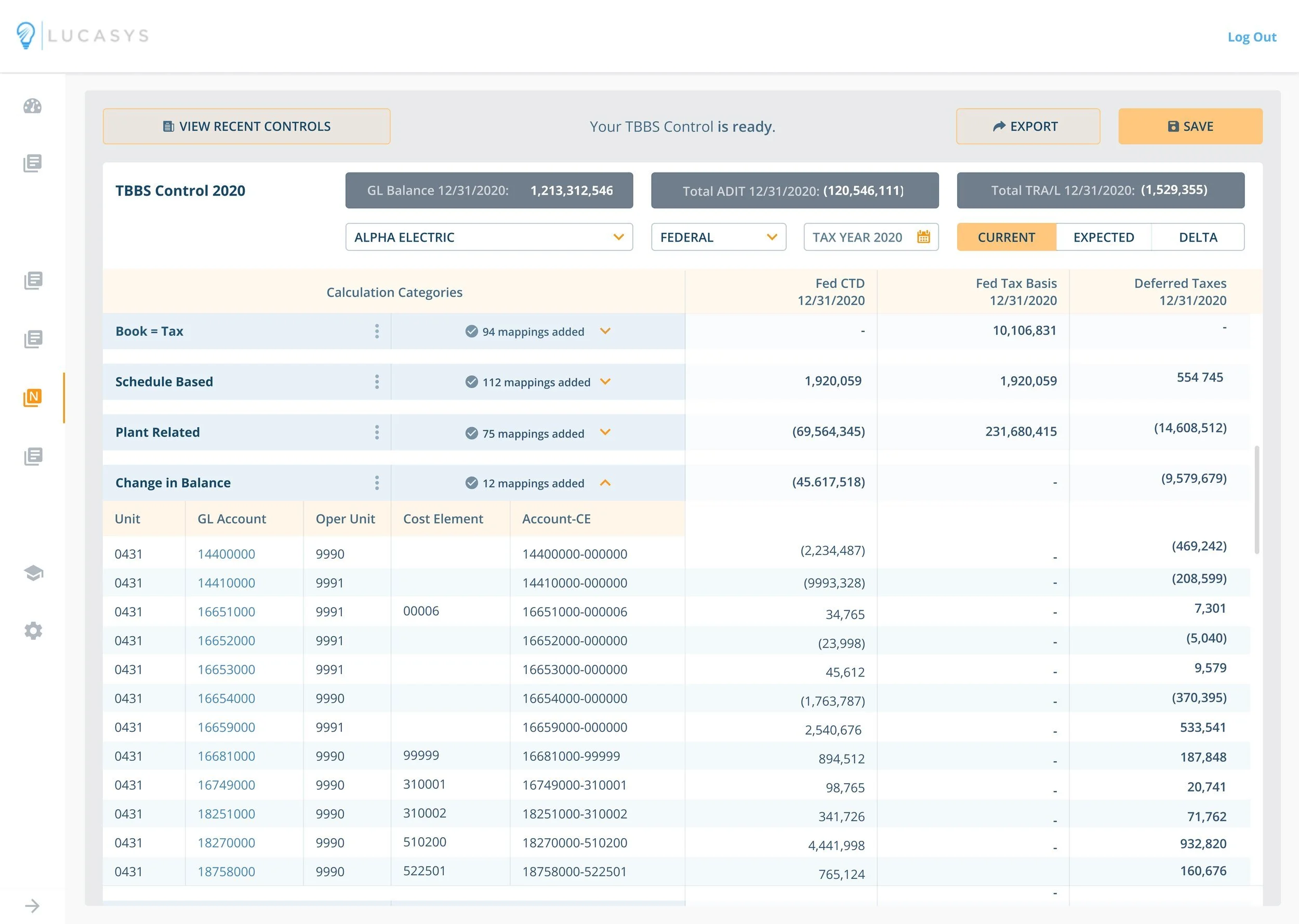

Lucasys TBBS Software

Assembling a complete tax basis balance sheet requires substantial effort and resources from a company’s tax department. Due to the investment of time and resources required, tax departments tend not to keep TBBS up-to-date because of the logistical hassle of maintaining the control and supporting files. Every year, new GL accounts are added to the trial balance, new timing differences are created, new companies are formed or acquired, and new tax jurisdictions are added or changed. These issues may be approachable in isolation, but as significant amounts of new accounts and timing difference are created across many companies, the ability to maintain a TBBS in a spreadsheet becomes difficult, if not completely impossible.

Lucasys TBBS automates the TBBS control and allows it to be maintained seamlessly over time. Lucasys TBBS was developed by a team with deep knowledge of TBBS controls and their maintenance requirements. By systematically maintaining all existing GL accounts and timing differences, a user can easily update the TBBS for new book and tax items across all companies at once. There is no need to start the TBBS from scratch, or to manipulate a massive spreadsheet while hoping that no existing formulas get broken. In addition, reporting becomes simple, both for single companies and for consolidated groups of companies. The Lucasys TBBS dynamic reporting capabilities allow customers to view and report on the TBBS in multiple ways, giving them the flexibility and ease of use that is not available through a spreadsheet.

To learn more about Lucasys TBBS, visit https://www.lucasys.com/tbbs-solutions.